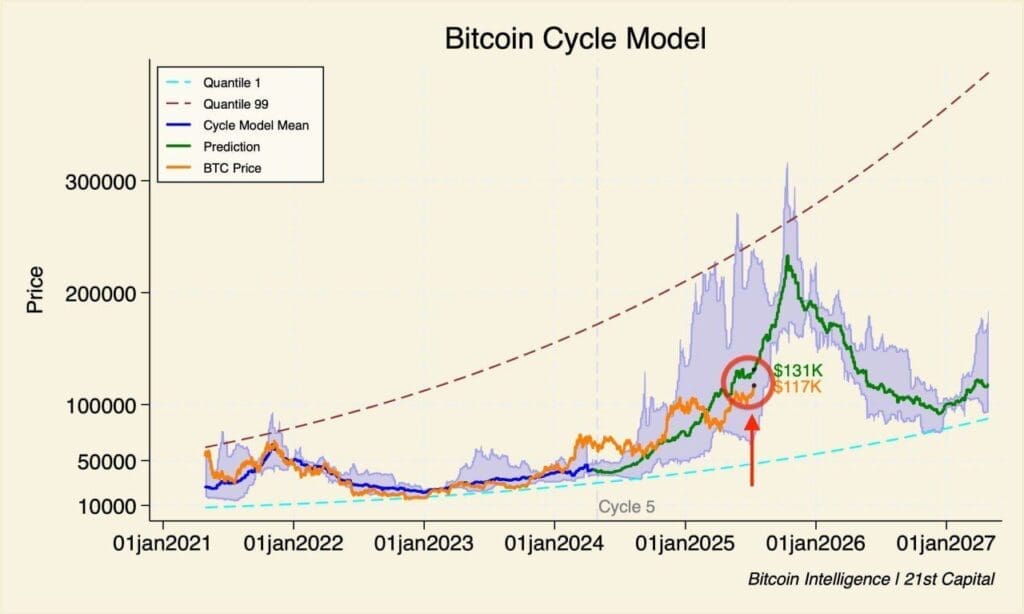

The Bitcoin market has followed clear cycles for years, with periods of sharp price increases followed by significant corrections. These cycles are shaped by factors such as halving events, macroeconomic conditions, and market sentiment. The “Bitcoin Cycle Model” shown here offers a visual overview of historical price patterns combined with a forecast model for the coming years. The analysis points to a potential new peak in the next cycle, with projected highs between $117,000 and $131,000.

This forecast places the current price action in a broader historical context, helping investors frame their expectations while staying aware of the risks inherent to Bitcoin’s volatility.

Understanding the Bitcoin Cycle Model

The Bitcoin Cycle Model is built on historical price data and uses statistical quantiles and average cyclical trends to forecast possible price paths. The main components in the chart are:

- Quantile 1 (light blue): The lower bound of expected price movements, based on historically conservative scenarios.

- Quantile 99 (purple): The upper bound of expected price movements, reflecting extreme bull market scenarios.

- Cycle Model Mean (blue): The average price development per cycle, derived from past market cycles.

- Prediction (green): The most likely price path according to the model.

- BTC Price (orange): The actual historical price of Bitcoin.

This approach aims to quantify Bitcoin’s inherent volatility by combining realistic boundaries with average values. The cycle numbers in the model refer to Bitcoin’s historical halving cycles, which occur roughly every four years and have a major influence on supply and demand dynamics.

🔍 Discover More Price Prediction Models

Want to explore other powerful tools alongside the Bitcoin Cycle Model that map out Bitcoin’s future price? Visit our Tools overview for a complete range of predictive models, on-chain analyses, and market indicators.

Chart Analysis

From early 2021, the orange line shows Bitcoin’s actual price, peaking above $60,000 in spring 2021, followed by sharp declines and a recovery in 2024 toward $70,000. The current market is at the start of Cycle 5, with the price recently beginning an upward trend.

The model projects that Bitcoin’s price could see strong growth over the next 12–18 months, with a possible peak between $117,000 and $131,000. This range—highlighted by the red circle in the chart—sits close to the upper bound of historical averages, but still below the extremely bullish Quantile 99 scenario, which stretches toward $300,000.

Notably, the model also anticipates a significant correction after the peak, with prices potentially falling back to between $60,000 and $90,000 by 2026–2027. This mirrors earlier cycles, where euphoric market tops were often followed by extended bear markets.

Bitcoin Intelligence / 21st Capital

The data in this chart comes from Bitcoin Intelligence, an analysis initiative by 21st Capital, focused on in-depth market models and data visualizations for Bitcoin. Their models combine historical price action with probabilistic forecasting to give investors insights into potential market trajectories.

More information and updates can be found through their official channels, including Bitcoin Archive on X.

Critical Reflection: Risks and Scenarios

While the Bitcoin Cycle Model provides a structured view of potential price paths, markets don’t always follow historical patterns. Macroeconomic recessions, tighter regulation, or unexpected liquidity crises can break the pattern.

The assumption that Bitcoin will reach a higher peak every cycle is not guaranteed. In a prolonged economic downturn or with declining institutional confidence, the peak could be lower than projected—or fail to materialize at all. Conversely, an extreme bull run like those seen in 2013 and 2021 could push the price well above the model’s forecast range.

For investors, this means the model is best used as a tool for scenario planning and risk management—not for exact timing or guaranteed price targets.

Get €20 FREE at the Most Affordable Crypto Exchange in the Netherlands

Finst gives you the ability to buy and sell crypto quickly and easily—at the lowest fees in the Netherlands. As the only exchange offering a Proof-of-Reserve guarantee, Finst ensures a 1:1 backing of your investments. This makes Finst one of the most trustworthy and secure platforms on the market.

Please note: The promotion in this advertisement is temporary and may be changed or ended at any time. Investing always carries risks, and it’s important to be fully aware of them.

Conclusion

The Bitcoin Cycle Model from Bitcoin Intelligence provides a valuable framework for understanding Bitcoin’s current and future price cycles. The projection of a peak between $117,000 and $131,000 in the upcoming cycle aligns with the historical trend of post-halving bull markets but comes with the risk of significant corrections afterward.

Anyone active in the crypto market can use these insights as part of a broader strategy that incorporates both optimistic and conservative scenarios. For a more complete picture of current on-chain data and broader market trends, it’s advisable to regularly review the full on-chain overview.